(Visited 12 times, 1 visits today)

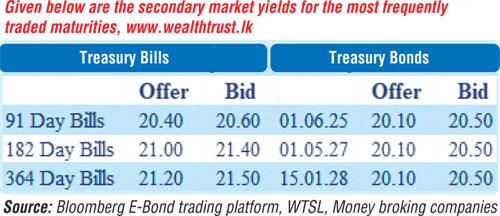

Secondary Treasury Bill market remains active ahead of T-Bond auctions

Recent Posts

- Why Sri Lanka Must Accelerate Its E-Lottery Transition

- Why Unleashing the Digital Economy Should Be Sri Lanka’s Top Priority

- Digital Transformation of Lottery to e-Lottery Models

- The Role of AI in Shaping the Future of Public Relations

- Sri Lanka at a Crossroads: From Devastation to a New Era of Resilience

- Sri Lanka in the Wake of the Cyclone, “Ditwah” : A Nation Counting Its Losses

- On the Ground at the National AI Expo & Conference: Key Announcements & Day 1 Learnings

- Sri Lanka Charts a Bold AI Future with First National AI Expo & Conference

- Listening → Lead → Leadership: Why Sri Lanka’s Politics Needs Empathy Now

- Stand Against the Fake: A Call for Truth, Accountability and Civic Courage

Subscribe for Newsletter

PRMinds Business Journal

PRMinds Business Journal is common place to view all business & economic related news in one page.

Categories

Recent Posts

- Why Sri Lanka Must Accelerate Its E-Lottery Transition

- Why Unleashing the Digital Economy Should Be Sri Lanka’s Top Priority

- Digital Transformation of Lottery to e-Lottery Models

- The Role of AI in Shaping the Future of Public Relations

- Sri Lanka at a Crossroads: From Devastation to a New Era of Resilience