Sustainable energy solutions - B2B energy solutions

Sustainable energy solutions – B2B energy solutions

Successful positioning in times of rising energy prices and increasing decarbonization needs

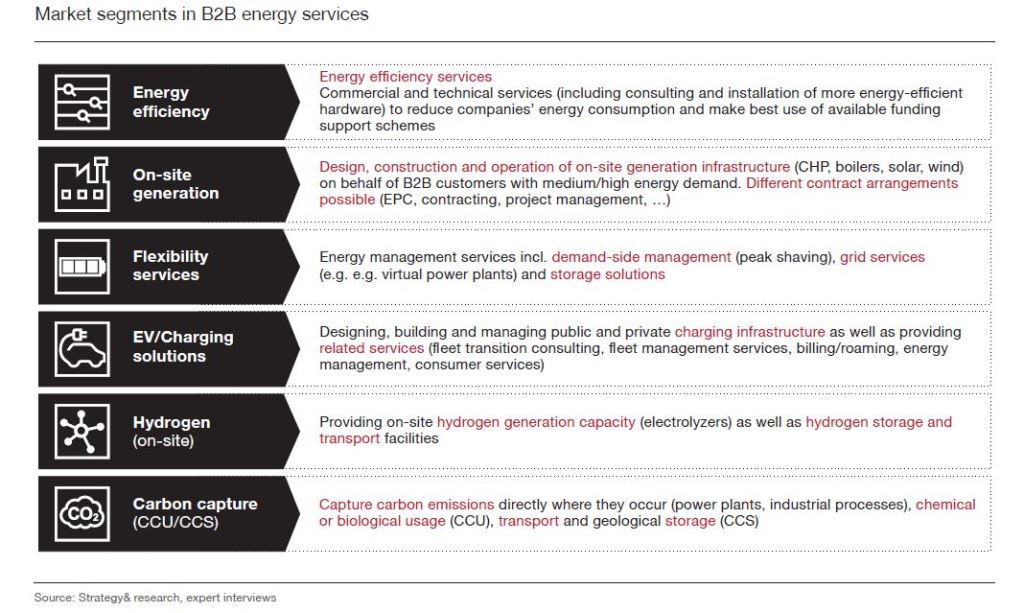

The market for sustainable B2B energy services is expected to grow significantly in Europe over the next 15 years. The war in Ukraine and growing pressure from the EU and national governments to cut carbon emissions have given further impetus to an already thriving market. Developing solutions that support decarbonization and make energy supply more affordable and secure – including energy efficiency services, on-site generation, and carbon capture and storage – is a key focus for all major industries across Europe.

In this study, global strategy& consultants assess opportunities in the booming energy services market: Which industries and customer segments are most attractive, how the market for the different services will develop, which companies are competing and what capabilities energy services companies need to succeed. The study is built on our market insights, desk research and more than 20 interviews with B2B energy services executives in Europe.

1. Energy crisis and sustainability ambitions will let the market grow to €100 bn. Electric mobility and hydrogen solutions are the largest growth markets

Global strategy& consultants expect the B2B energy solutions market to grow four-fold to €100bn by 2035 in core European markets (Germany, the Netherlands, UK, Italy and Poland). Energy efficiency services and on-site generation are significant and mature market segments already, but have the potential to grow by more than 10 percent a year. Electric vehicle charging and hydrogen solutions for B2B customers are expected to grow fastest, with growth rates of 20-30% per year.

Carbon capture technology is now emerging as a new segment in the market. Commercialization is imminent and both carbon capture and storage (CCS) and usage (CCU) will play a significant role in decarbonization solutions for industrial customers, especially after 2030.

2. Energy service contracts are long and capital-intensive, so choosing the right customers is essential

Selecting attractive industries and customers is essential for the sustainable commercial success of the energy services provider: energy consumption and industry growth are indicators of suitable potential clients: industries with medium energy consumption and medium to high growth offer the greatest sustainable potential for energy services companies. But companies also need to be individually evaluated on factors including size, financial strength and product portfolio. Our observation is that many energy service companies need to improve their customer segmentation and selection process.

3. Customer focus and access to the right technologies are the most critical capabilities

Successful energy services companies integrate strong commercial, technical and project management skills, including the ability to bring complex technologies together in one offering. Although technical skills are important, many energy service companies struggle with the need to increase customer orientation inside their organizations. For example, sales organizations need to be structured by customer segments/industry, not by technology.

4. The market is still very fragmented – global strategy& consultants expect a further consolidation in the next years

All larger energy and utility companies in Europe are now offering B2B energy solutions, but with varying degrees of commitment. Some take part only in selected market segments, others offer a broad range of energy services. There are only a few pan- European players that are independent of the larger energy and utility companies. In the past years, several new companies have entered the market or significantly expanded their offerings.

5. Global strategy& consultants expect M&A activity to pick up in the next 12-24 months

The strong growth of the industry will also be fired by the inflow of new players and investors into the market. Inorganic growth is the best option to put in places the necessary capabilities, regional coverage and critical scale. Joint ventures or potential co-investments with private equity firms can lower the financial risks. According to the strategy& team, as a result they see a strong increase of M&A activities in the next few years.

6. Energy services customers need to choose carefully the best suitable partner for their needs

As energy solutions are becoming more and more complex, especially decarbonized solutions, it is crucial to choose the right energy service partner who is capable of managing all relevant technologies and regulations. Our interviews have shown that reliability, stability, responsiveness, access to regional counterparts while offering the right regional breadth as well as efficiency of services at a competitive price point are key selection criteria. Especially for larger corporations also the brand and reputation of the service provider is of increasing importance. Established and stable energy services providers with a history of successful projects are therefore in the pole-position especially for large and complex energy services contracts.

Why energy services are increasingly important

Energy supply risk has been brought into the spotlight by the war in Ukraine. The spike in prices is a heavy burden for all industries. Especially for the energy-intensive industries energy resilience and the need to reduce reliance on gas is a key topic. This will be reflected in the increasing demand for B2B energy services.

Energy services such as energy efficiency consulting or energy contracting solutions, such as for heat, have been around for a long time. They have lately become significantly more important for the following reasons:

- The war in Ukraine increases the need for independent and cost-effective energy supply, particularly in Europe.

- Environmental legislation, customer expectations and capital market demands are pushing companies into an extensive green transformation and increasing the pressure to decarbonize their energy supply.

- Energy supply is moving toward more decentralized solutions, such as on-site solar or wind power for factories, providing new growth opportunities for utility companies and other energy market participants.

As a result, companies – especially organizations for whom energy supply was not a key priority in the past – are now increasingly under pressure to implement cost-efficient and carbon-neutral energy solutions. Energy supply is clearly on the C-level agenda now. Industrial companies need external help from energy service companies to manage the necessary transformation.