Telecoms as platforms: The mega-scaling opportunity of unicorn partnership

Telecoms as platforms: The mega-scaling opportunity of unicorn partnership

Dr. Florian Gröne, Vicki Huff Eckert, and Amit Adalti

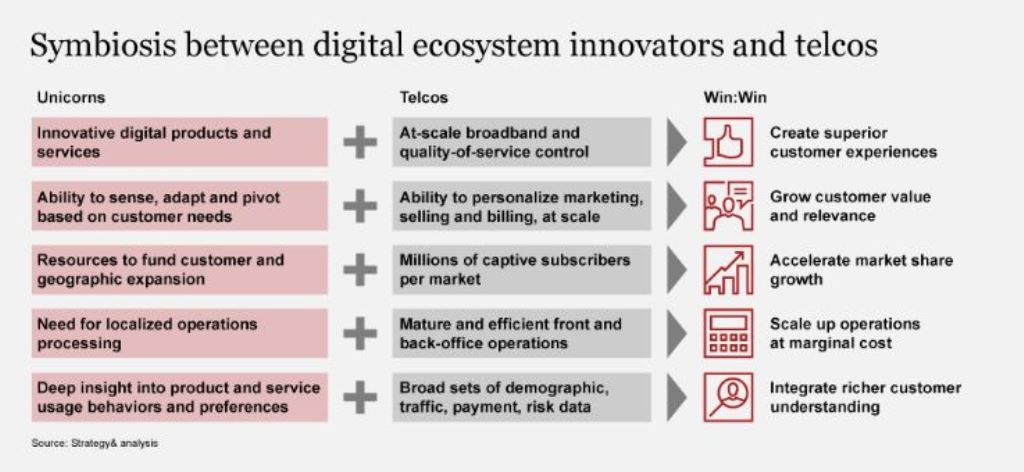

Telecom operators seem to be stuck. Growth forecasts remain low, while their acquisitions and attempts at innovation have yielded rather meager rewards. However, the dramatic rise of the unicorn economy – despite market downturns – offers the potential for revitalization, a major opportunity to change course and pursue dynamic partnerships within digital platforms and ecosystems. The respective capabilities of unicorns and telecom operators can be deployed to powerful effect. While the unicorns are built to innovate, telecom operators can immediately provide them with what they often lack in their quest for rapid scale – mass distribution, tailored connectivity, and highly developed operations and customer service.

The telecom growth conundrum

Market saturation and the maturity of their core offerings and business model have resulted in persistently low growth forecasts for telecom operators. Their multi-billion-dollar investments in 5G and multi-access edge computing (MEC) infrastructure have usually only served to retain already established revenue, unless they themselves manage to translate this investment into creating richer experiences and use cases that provide value to customers. They continue to struggle to establish themselves in the digital economy – encompassing software, apps, solutions and content – while any incremental growth has come through market share gain at the cost of more competitive pricing and costly promotions. Their strategy of banking on in-house innovation has missed its target, while mergers and acquisitions seeking expansion into adjacent sectors have tended to center on the wrong targets at the wrong time.

In short, telecom operators are sitting on a large, stable broadband commodity business, using network infrastructure, operations and service distribution that are expensive to sustain. To compound matters, most of them have been unable to grasp the fruits of the massive growth in digital service and commerce business and have had to look on as huge technology companies dominate that lucrative market.

Such a predicament may appear somewhat bleak. However, renewed growth is nevertheless attainable if they divert their focus from competition to symbiotic partnership. Instead of worrying about rectifying weaknesses, telecom operators can more profitably concentrate on what their substantial strengths can bring to the table.

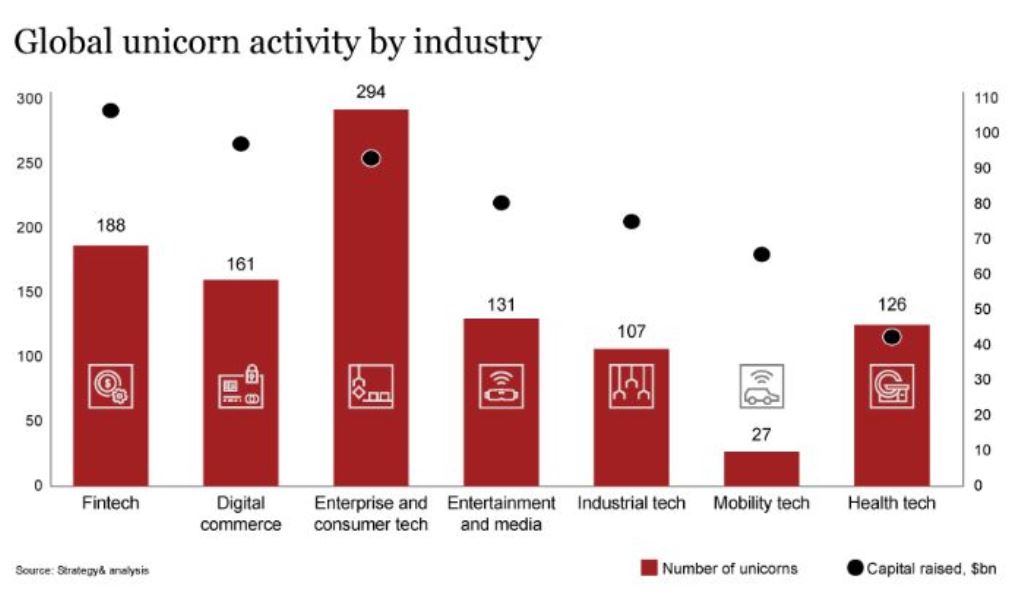

The rise of the unicorn

The opportunity for telecom operators lies in the unicorn economy, which has mushroomed in the era of Web 3.0. While previous phases of digital evolution have been dominated by a few massive companies, Web 3.0 is being fashioned across multiple industries by hundreds of unicorn-type companies, privately held startups with a value of more than US$1 billion. From 2016 to 2021, the number of unicorns jumped from 165 to 743, an increase of 350% in just five years, with the cohort raising capital of US$ 565 billion.

These companies are leading the way to the next version of the digital economy. The success of these companies can be attributed to various factors. They solve the most critical consumer and business problems in new, disruptive and digitally-enabled ways; they gain rapid traction with customers, especially with younger segments who are molding the future of business; and they can attract huge sums of money from savvy investors.

However, to maximize their business potential, they have to get two things right. First, they have to ensure ubiquitous connectivity. The products and experiences that unicorns offer – from immersive entertainment in the metaverse, to connected health, personal finance and travel – rest on the requisite level of speed, latency and security. Second, they must respond to the pressure to scale their businesses rapidly, both domestically and across international borders. The speed of this expansion allows them to justify valuations by creating and dominating markets in a way that fends off competition and maintains profitability, at least for a while.

A symbiotic partnership

Telecom operators are ideally positioned to cater for these two requirements. They can provide both the connectivity and the access to huge captive audiences. Indeed, there are currently 22 telecom operators which boast subscriber bases of at least 100 million customers, 18 of which operate in more than one country.

We are entering a new era, with 5G and next-generation networks adding hugely to the appeal of leading-edge digital experiences, such as immersive gaming and entertainment, or critical industrial and health applications. Moreover, the consumer electronics industry is expanding into wearables, smart homes or cars, all of which demand built-in connectivity. Both these trends open the door for telecom operators to play an important role in the unicorn economy and Web 3.0 through the provision of high-performance networks and devices.

Further telecom strengths include established customer relationships, retail presence, payment and collection operations, technical support, customer service and detailed consumer insights. These capabilities can relieve unicorns of operational burdens that demand a great deal of investment and labor, while they focus on what they do best – innovation.

Telecom operators can also gain from the partnership. They can avail themselves of the innovation generated by unicorns to give their subscribers more of what they want out of digital life – experiences, services, solutions and gadgets – and as a result broaden existing customer relationships into new categories, boost customer wallet share, and cement loyalty.

Some are already pursuing this partnership opportunity. Business models oriented towards digital platforms are gaining traction among telecom operators around the world. In Europe, Vodafone and Deutsche Telekom are signaling a commitment to building more integrated network and service platform stacks to power solutions and experiences devised by partners. In Asia, SK Telecom is actively shaping a broader ecosystem with partners in media, security, mobility, ecommerce and health, while Rakuten is building a growing portfolio of subscription businesses across multiple sectors. In the United States, too, companies such as Verizon have prioritized the development of platform-based ecosystem plays.

Identifying the unicorn partnership opportunity

Unicorn-type players operate in various digital ecosystems (Figure 2). They are constantly unearthing and then capitalizing on major new opportunities within each and are ideally primed for partnerships that can equip them with the massive international scale they crave. Telecom operators need to understand precisely how these ecosystems work in order to identify openings and shape their partnership proposition. There is a wide range of new service offerings whose potential could be amplified through a symbiotic partnership between telecom operators and unicorns.

In the fintech space, consumer apps have moved beyond digital commerce payment processors and have now expanded into such areas as point-of-sale lending (buy now, pay later schemes), wealthtech (facilitating low-fee digital investments and wealth management), and digital currencies, a market which has undergone major recent expansion. Indeed, of the 22 unicorns identified in a PwC study that are associated with cryptocurrencies and other digital assets, 13 had only become unicorns after the high-profile Coinbase IPO announcement in February 2021.

For various reasons, telecom operators could be ideal partners for these players. First, they already provide consumer lending for device purchases, and could expand this offering for other categories. Second, they boast credit and risk algorithms that are on a par or maybe even better than those of traditional banks and can achieve accurate and accelerated credit scoring. Third, they have assets and capabilities in know-your-customer enrollment and at the point of sale that financial services companies might need.

Telecom operators can fulfill a much-needed role in consumer tech too, supporting the growth of the market in a number of ways. The ecosystem surrounding smart and connected homes has attracted a wide range of players, offering products and services such as gadgets, sensors, consumer electronics, software integration, data analytics, home security and insurance. Telecom operators can provide distribution alongside their established broadband subscription, simplify charging for services by condensing everything into one bill, or supply service providers such as utilities, security or insurance companies with connected sensors and predictive analytics relating to energy consumption, gas and water leaks and burglaries. With the expansion of FTTx and fixed wireless access broadband, many telecom operators are extending their reach and capabilities, adding potential scale to this opportunity.

Unicorns are entering new digital commerce ecosystems centered on grocery and food delivery services that are traditionally provided by retailers, digital commerce companies and logistics providers. This sector benefited greatly from the Covid-19 pandemic. Thirteen out of the 32 companies studied achieved unicorn status during this period. Telecom operators can both offer and derive several benefits from a relationship with unicorns in this ecosystem, not least the ability to offer swift home delivery of many more smaller purchases.

New ways of delivering telehealth and wellness have also been supercharged by the pandemic. Thirteen new telehealth companies and 14 health analytics platforms reached unicorn status during this time. Biotech is one sector that holds out great promise, for example in the area of drug and vaccine development through mRNA, artificial intelligence and other technology.

In this space, telecom operators stand to gain by connecting with a new generation of health-focused consumers, both young and more elderly. In this way, they can convey a brand identity that values the importance of mental and physical well-being and understands the challenges of an ageing society. Health-tech players could benefit from a partnership with telecom operators, for example by incorporating subscription fees into broader telecom packages, or by gaining instant access to physical retail space to showcase new auxiliary gadgets and fitness equipment.

Realizing the potential of unicorn innovation: Shaping a partnership strategy

To take advantage of the partnership opportunity, telecom operators need to define a unicorn-centered strategy and roadmap which answers a series of questions.

First, they should identify the ecosystems to target and in what order of priority, based on what their customers are saying they want. By their actions, unicorns are already indicating the customer problems that are worth solving. The knowledge of what is already happening on the ground should be combined with the telecom operator’s own thorough analysis of customer needs and appraisal of the opportunities in the various ecosystems.

Second, they need to shape a customer value proposition that combines the symbiotic assets and capabilities of telecom operators and unicorns. Effectively defining this proposition would allow both parties to differentiate themselves in the marketplace and provide incremental value to customers, a win for all parties.

On a similar note, telecom operators also need to spell out their partner value proposition. What is it exactly that telecom operators are contributing to the partnership with unicorns?

To answer this question, they need to understand the unsatisfied commercial and technology-related needs of unicorns in a given ecosystem and then describe how the symbiotic relationship would work. The output of this exercise should not be a long contract, but term sheets which explain how the two parties would pool their resources, for example through joint skunkworks, agile task forces or complex system integration programs.

Third, the revenue opportunity needs to be assessed and broken down. Once the value of both the overall customer proposition and the respective contribution of the partners has been figured out, the parties can design both the business model and an equitable revenue share arrangement.

Fourth, telecom operators need to work out how they will oversee the partnership. As such, they should build a process for searching, screening and qualifying potential partners, and then set up a team with the requisite capabilities to manage all partner relationships on an ongoing basis and identify any new partnership opportunities.

Finally, they should identify those areas of their proposition that require enhancement in order to bolster appeal to potential partners. Indeed, a structured analysis and design of business architecture is an increasingly important discipline for telecom operators, enabling them to establish where platform capabilities are deficient, and identify necessary improvements in talent, process and technology. The immediate priority should be investment in an upgrade of their own customer operations processes and systems to make them partner-ready.

To maximize the potential of the partnership, internal organization and culture will also have to evolve. The team designated to handle the unicorn partnerships must be given the latitude to operate outside the core telecom business, challenge the industry orthodoxies, try out new ideas and execute quickly. Silos need to be pulled down to meld internal expertise from various areas – strategy, analytics, product, sales and marketing, and technology architecture – for the benefit of the partnerships.

Telecom operators are likely to garner a further welcome bonus from the partnership venture. The investment that goes into improving the partnership proposition, the breaking down of internal barriers, and the winning concepts and new platform services that emerge from the more entrepreneurial culture of the partnership team, can all work to the benefit of the core business itself.

Change tack for renewed growth

Change tack for renewed growth

Although they currently find themselves at something of an impasse, telecom operators are well positioned to monetize innovation and revitalize growth by developing a convincing proposition to partner with unicorns in targeting opportunities within selected digital ecosystems.

Source: PwC Strategy& Parent (UK) Ltd